We think of financial freedom as the ability to make decisions without fear of not being able to support oneself financially. You’ll almost always need a plan to attain to true financial freedom. And it’s here that we often get trapped. We are so engrossed in day-to-day life that financial independence appears to be a pipe dream. However, if we view financial independence as a series of small steps, the goal becomes more attainable and practical. It also helps to make the journey less daunting.

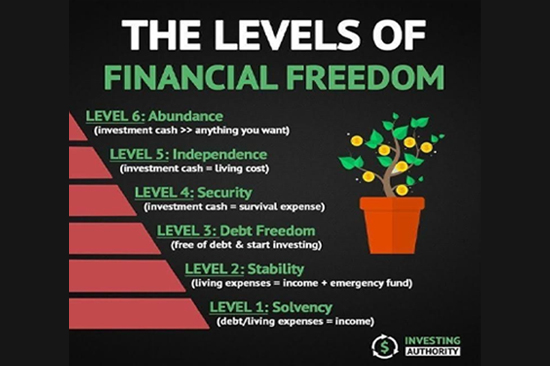

The series of small steps or goals, also known as the levels of financial freedom are as follows:

Solvency

Things aren’t simple at this level, and you might be unhappy with your financial situation.

You’re probably reliant on others financially. And at this point, you can probably only go on like this for a short time.

Stability

When your outgoings and expenses are equal to your earnings, you have “survival.”

You should be able to fulfill your financial obligations, pay all of your bills, and not rely on anyone or anything to assist you handle your expenses at this point.

Debt Freedom

You can begin saving whenever you’ve been able to consistently meet your financial obligations, have paid off some debts, and have kept your costs low. First, set aside money for an emergency fund, and then set aside money for long-term growth.

Safety and security

We believe it’s time to start investing when you’ve built up your emergency cash.

When you’ve developed a solid investment foundation, you shouldn’t have to rely on your salary to fund your basic expenses. You may be successfully developing and managing your wealth and on your way to achieving financial independence.

Independence

You should have established good, long-term investments by now. And the income from your investments is sufficient to support your current lifestyle. At this point, your wise investments should be paying you handsomely.

Abundance

You should have enough investment income that you have more than you need. Here your focus should be on sensible stewardship of this wealth for any beneficiaries.

Financial independence will take time to achieve, but with peace of mind and confidence, control over your fate will be well worth the effort.

Vita Wealth Management LLC, Dubai

Vita Wealth Management LLC, Dubai hello@vitawealth.co

hello@vitawealth.co +971 4 346 6567

+971 4 346 6567